michigan unemployment income tax refund

But even as workers await the document the state has yet. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

Pin On Fbi Statedepartment Crimescene Cybercrime Stalking Abuseofpower Idampan Dylanimp Wilst Idamariapan Interpol Pan Not Peterpan T

Unemployment refunds are scheduled to be processed in two separate waves.

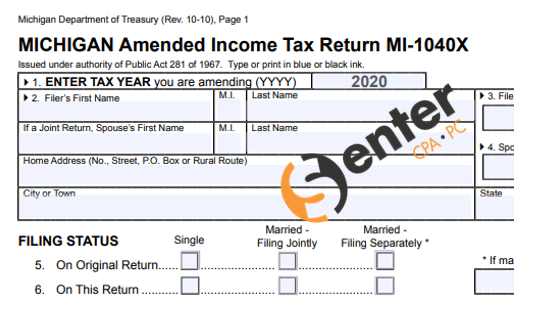

. - Taxpayers who filed their state individual income tax returns and collected unemployment benefits in 2020 should consider filing an amended return if they havent yet received their entitled tax relief according to the Michigan Department of Treasury. For the federal income tax return total unemployment compensation is reported on Line 7 of federal Form 1040 Schedule 1. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings.

Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment. Therefore unemployment compensation is also included in Michigan taxable income. Account Services or Guest Services.

These taxpayers should file an amended Michigan income tax return to claim that refund. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes. If Your Refund is HeldOffset to Pay a Debt.

They say thats because the federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and state income taxes. The Michigan Department of Treasury is urging taxpayers to file amended Michigan individual income tax returns if they have already filed without reporting unemployment compensation exclusions for the 2020 tax year. Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020.

Unemployment compensation is generally included in adjusted gross AGI income under the IRC. To complete properly check Box N and on line 8 Explanation of changes please write Federal Unemployment Exclusion. In the latest batch of refunds announced in November however the average was 1189.

Include schedule AMD which captures the reason why you are amending the return. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. If you use Account Services select My Return Status once you have logged in.

4 Effect of the American Rescue Plan Act on the taxation of unemployment compensation. When you create a MILogin account you are only required to answer the verification questions one time for each tax year. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from.

The federal American Rescue Plan Act was signed into law on March 11 2021. The net taxable unemployment compensation from federal Form 1040 Schedule 1 is included in federal. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200.

See How Long It Could Take Your 2021 State Tax Refund. Include all forms and schedules previously filed with your original return. The federal unemployment exclusion is reported on line 8 of the federal Form 1040 Schedule 1.

Additional Income and Adjustments to Income. The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts such as delinquent taxes state agency debts garnishments probate or child support orders overpayment of unemployment benefits and IRS levies on individual income tax refunds. There are two options to access your account information.

President Bidens recent federal American Rescue Plan Act excludes unemployment. As a result taxpayers who may have anticipated owing taxes may now actually be entitled to a refund. Contact the IRS only if your original refund amount shown on the BFS offset notice differs from the.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. You pay tax in your home state only. Michigans state income tax is 425.

Use the MI-1040 and check the amended box. Contact the BFSs TOP call center at 800-304-3107 or TDD 866-297-0517 Monday through Friday 730 am. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return.

Paula Gardner Email Business Watch. Previously taxpayers were encouraged to wait to make any amendments to their Michigan returns as the Internal Revenue Service IRS confirmed it. The second wave will recalculate taxes owed by taxpayers who are married and filing jointly as well as individuals with more complicated returns.

February 16 2022. As long as you meet the qualifications like making under 150000 youll be refunded all unemployment tax paid in 2020 if you received less than 10200 in. If you dont receive a notice.

The Michigan Department of Treasury has posted a notice for taxpayers related to the treatment of unemployment compensation for tax year 2020. However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. You may check the status of your refund using self-service.

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. June 1 2019 236 PM. Say Thanks by clicking the thumb icon in a post.

The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and state income taxes. Michigan residents now are looking at an extra long delay in receiving key tax paperwork from the state Unemployment Insurance Agency.

The state UIA said Monday that 1099-G forms now will be sent. That means the average refund for one week of unemployment from last spring and summer would be roughly 40.

How To Do Your Tax Return In Germany Youtube

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Inicio Mi Pareja Mi Espejo Self Help Online Security Self

A Map Of Sloth Map Global Peace Index Infographic

Hb 1302 Tax Refund Schedule Can Your Tax Refund Be Deposited On Sunday Marca

Charlie Evans Spoke Today At A New York Association Of Business Economists Luncheon On Risk Management And The Credi Risk Management Monetary Policy Management

A Map Of Sloth Map Global Peace Index Infographic

A Map Of Sloth Map Global Peace Index Infographic

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Taxing Wages Data Visualization Powerpoint Word Economy

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits