r&d tax credit calculation example uk

Fifty percent of that average would be 24167. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss.

Woman Doing Accounting At Home In 2022 Accounting Services Accounting Business Tax

Take the greater of the base amount calculated or 50 of.

. ForrestBrown is the UKs leading specialist RD tax credit consultancy. 100k QE in this example. Average calculated RD claim is 56000.

See If Youre Eligible To Claim A RD Tax Credit. According to the latest available figures UK companies claimed a total of 74. To reward businesses for their investment the government allows you to enhance your qualifying expenditure.

Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. The Ace Example PLC after RD should be an accounting profit of 3240000 with CT due of 375600. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

If You Dont Qualify You Dont Pay. ForrestBrown is the UKs leading specialist RD tax credit consultancy. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

The Research and Development Expenditure Credit rate changed. Show how this example is calculated. See If Youre Eligible To Claim A RD Tax Credit.

So as the enhanced RD tax relief is 230 a cash credit can be worth as much as 3335p for each 1 of eligible RD expenditure. If You Dont Qualify You Dont Pay. Multiply the fixed-base percentage by the average annual gross receipts from the previous four years to determine the base amount.

The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively. 50000 x 130 enhancement rate. The RDEC is a tax credit it was 11 of your.

A Profitable SME RD Tax Credit Calculation Lets assume the following. The RD Tax Relief scheme allows a further deduction to be made calculated as 130 of the qualifying expenditure identified. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as.

Calculate how much RD tax relief your business could claim back. The average R. Paid within 4 weeks of submitting claim.

Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. The RDEC is a. A number of webistes provide a handy RD tax.

This credit appears in the Internal Revenue Code section 41 and is. It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company. Free RD Tax Calculator.

HMRCs incentive allows you to enhance these costs by 130 turning your 100k to 130k enhanced RD spend. This means that they get a reduction in their corporation tax liability. If youre a loss-making business youll receive your RD tax credit in.

The net benefit to the company is the pre RDEC CT due less the post. Average calculated RD claim is 56000. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process.

The email address in the When you cannot use the online service section has been updated. Assuming your business fits these criteria you can check below for example calculations for RD tax credits.

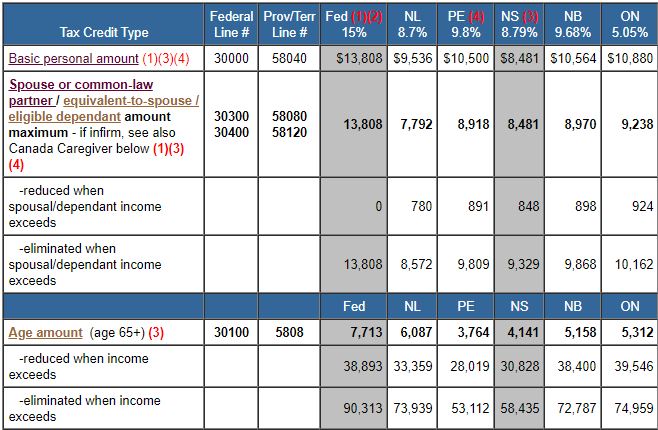

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

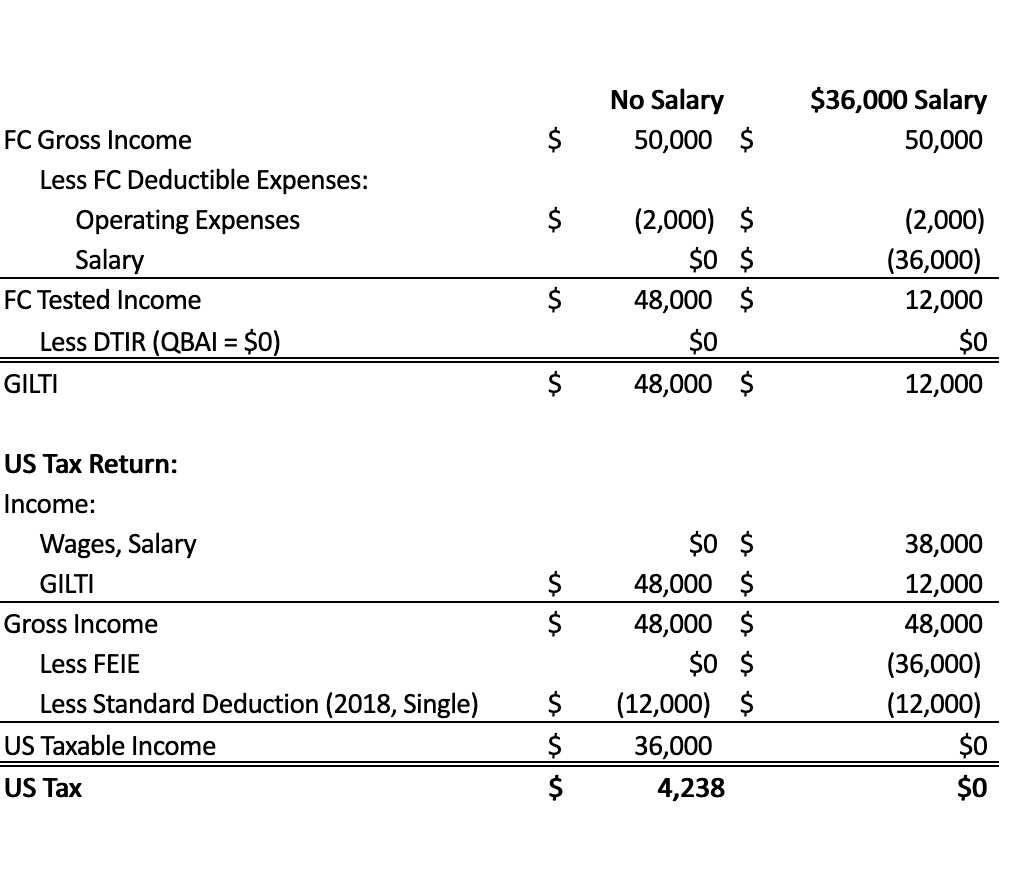

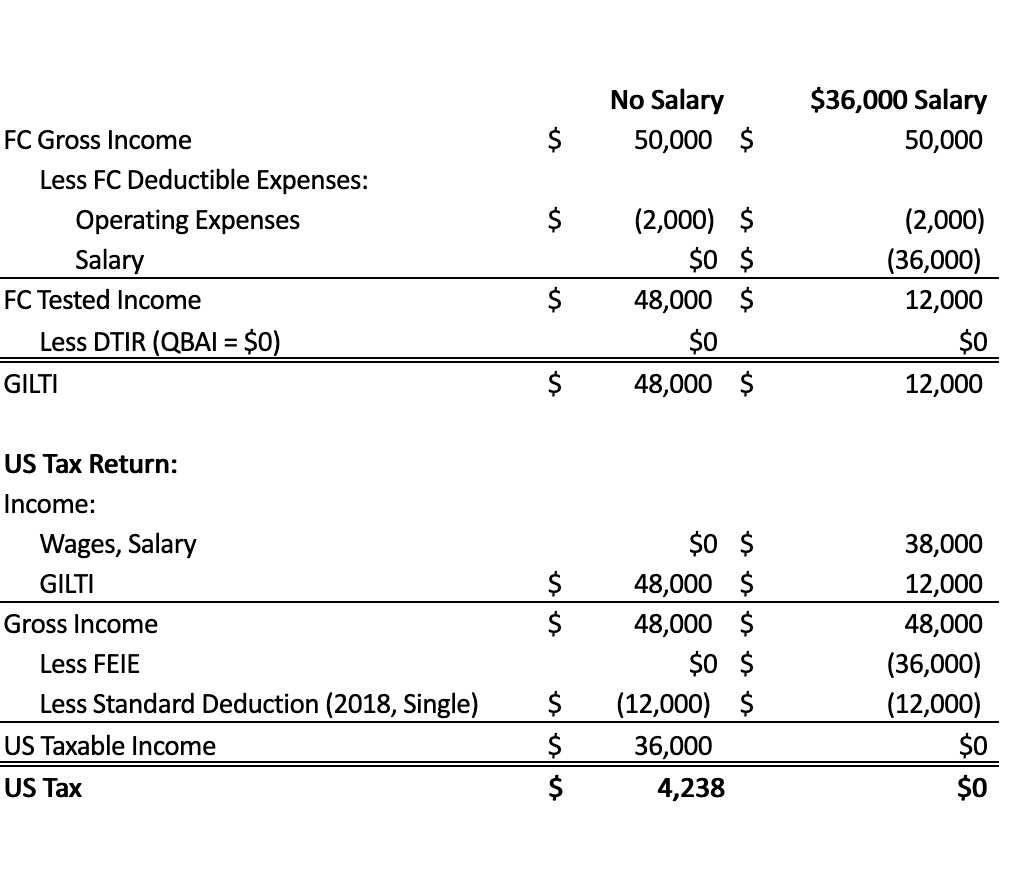

R D Tax Credit Calculation Methods Adp

R D Tax Credit How Your Work Qualifies Alliantgroup

%20(2).gif)

R D Tax Credits Explained How To Claim And Who Is Eligible

R D Tax Credit Calculation Methods Adp

R D Tax Credits Explained How To Claim And Who Is Eligible

.png)

R D Tax Credits Explained How To Claim And Who Is Eligible

.png)

R D Tax Credits Explained How To Claim And Who Is Eligible

.png)

R D Tax Credits Explained How To Claim And Who Is Eligible

R D Tax Credits Explained How To Claim And Who Is Eligible

R D Expenses Capitalised Or Expensed Pros And Cons

Getting To Know Gilti A Guide For American Expat Entrepreneurs

.png)

R D Tax Credits Explained How To Claim And Who Is Eligible

3plw Business Model Canvas Business Model Canvas Business Model Canvas Examples Business

3plw Business Model Canvas Business Model Canvas Business Model Canvas Examples Business

Free Bookkeeping Spreadsheet For Self Employed Business Owners Bookkeeping Business Bookkeeping Finance Blog